are campaign contributions tax deductible in 2020

While there is no tax. An anonymous contribution of cash is limited to 50.

Happy New Year 2020 Calendar New Year Holiday Design Elements For Holiday Cards Calendar Happy New Year 2020 New Year Holidays Social Media Design Graphics

Learn how campaign contributions can be used when an election is over.

. The per-calendar year limits became effective on January 1 2019. Paid for by the Sam Jones for Congress Committee For details visit Advertising. Changed in the 2020 tax year that allowed taxpayers to deduct as much as 300 for each tax of qualified cash contribution.

Usually you can only deduct charitable contributions if you itemize deductions by filing Schedule A along with Form 1040. Are Political Contributions Tax. The bottom line is if you dont itemize and take the standard deduction you cant deduct charitable donations.

The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage usually 15 percent of the taxpayers aggregate net income or taxable income. Free easy returns on millions of items. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US.

When a campaign solicits contributions through public communications or on a campaign website it must include a clear and conspicuous notice on the solicitation stating that it was authorized and paid for by the campaign. If you claim the standard deduction you cant deduct charitable contributions. What charitable contributions are tax deductible in 2020.

Browse discover thousands of brands. Ad Help fund our testing programs by making a tax-deductible donation. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

Individuals can elect to deduct donations up to 100 of their 2020 AGI up from 60 previously. Political donations are not tax deductible on federal returns. Ad Free shipping on qualified orders.

With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to federal office. This amount doubled for the 2021 tax year for married people filing jointly and 300 for.

For people that want to donate money to a political campaign it is essential to think if one can deduct it from your tax return. Want to improve your tax management as an investor. The Federal Election Commission FEC has released the campaign contribution limits for individual private citizens for the 2019-2020 election cycle including the presidential election on November 3 2020.

Any amount in excess of 50 must be promptly disposed of and may be used for any. The amount an individual can contribute to a candidate for each election was increased to. Read customer reviews find best sellers.

No political contributions are not tax-deductible. Corporations may deduct up to 25 of taxable income up from the previous limit of 10. 50 limit on anonymous contributions.

You cannot deduct expenses in support of any candidate running for any office even if. For C Corporations the 25 limit is based on their taxable income. The 2019-2020 contribution limit was capped at 2800.

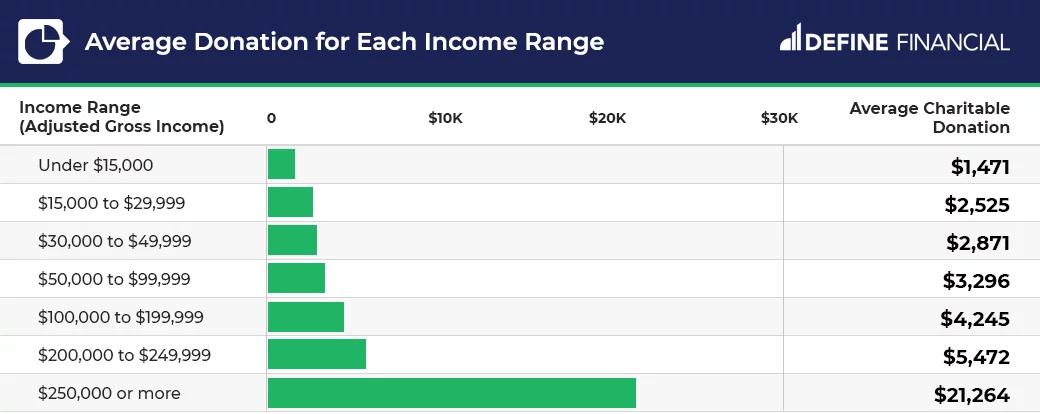

When people do give most political donations are large given by a few relatively wealthy people. With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year. In relation to this RMC 38-2018 provides that only those donationscontributions that have been utilizedspent during the campaign period as set by the Comelec are exempt from donors tax.

For contributions made in 2020 the limit for these contribution deductions is increased from 15 to 25. Its only natural to wonder if donations to a political campaign are tax deductible too. The 2019-2020 contribution limit was capped at 2800.

Changed in the 2020 tax year that allowed taxpayers to deduct as much as 300 for each tax of qualified cash contribution. The Combined Federal Campaign CFC is one of the largest and most successful workplace fundraising campaigns in the world. The new deduction is for gifts that go to a public charity such as Make-A-Wish.

The answer is no political contributions are not tax deductible. Count me among those smaller donors who has given a bit here and there to campaigns. For other businesses including sole proprietorships partnerships and S corporations the limit is based on their aggregate net income for the year from all trades or businesses from which the.

Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. For contributions of food inventory in 2020 business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all. Generally only a small minority of total contributions come from those who give 200 or less.

No political contributions are not tax-deductible. However for tax year 2021 the taxes you file in 2022 you can deduct charitable contributions up to 300 without itemizing deductions.

Our Target 100 Credit Arpproval

/dotdash_Final_How_Does_Total_Capital_Investment_Influence_Economic_Growth_Nov_2020-01-49f1a03cca95496b87fb7e2c7b24341d.jpg)

Does Total Capital Investment Influence Economic Growth

Political Financing Handbook For Registered Parties And Chief Agents Ec 20231 June 2021 Elections Canada

Give Lively Faq Are Donations Made Through Give Lively Tax Deductible

80 Charitable Giving Statistics Demographics 2022

How Deceptive Campaign Fund Raising Ensnares Older People The New York Times

50 Free Receipt Templates Cash Sales Donation Taxi

How Deceptive Campaign Fund Raising Ensnares Older People The New York Times

Turbotax Itsdeductible Track Charitable Donations Charitable Donations Charitable Charitable Contributions

National Nonprofit Day Stem Students Education Stem Education

Are Political Contributions Tax Deductible H R Block

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

21 Free Cash Receipt Templates Word Excel And Pdf

Are Political Contributions Tax Deductible H R Block

Receipt Forms Free Receipt Forms For Small Business

Pin On All About The Money Group Board Make Money Side Hustle Budgeting Passive Income Save Money Frugal Living